What Is The Self Employed Health Insurance Deduction

Read on for some basics of the self employed health insurance deduction. However the irs says you may purchase your health coverage in your own name and still get the self employed health insurance deduction.

Claiming The Self Employment Health Insurance Tax Deduction

Claiming The Self Employment Health Insurance Tax Deduction

what is the self employed health insurance deduction is important information accompanied by photo and HD pictures sourced from all websites in the world. Download this image for free in High-Definition resolution the choice "download button" below. If you do not find the exact resolution you are looking for, then go for a native or higher resolution.

Don't forget to bookmark what is the self employed health insurance deduction using Ctrl + D (PC) or Command + D (macos). If you are using mobile phone, you could also use menu drawer from browser. Whether it's Windows, Mac, iOs or Android, you will be able to download the images using download button.

Irs chief counsel memo 200524001.

What is the self employed health insurance deduction. You may be able to deduct the amount you paid for health insurance for yourself your spouse and your dependents. If you buy your own health insurance you should definitely know about the long standing health insurance premium deduction for the self employed. The premium tax creditwhich reduces your share of the insurance premiumsis based on income you may have some extra credit to claim or have to pay some back when you actually file.

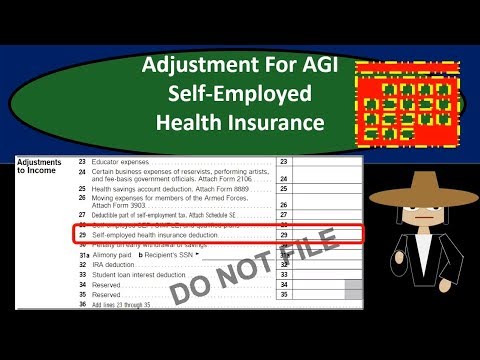

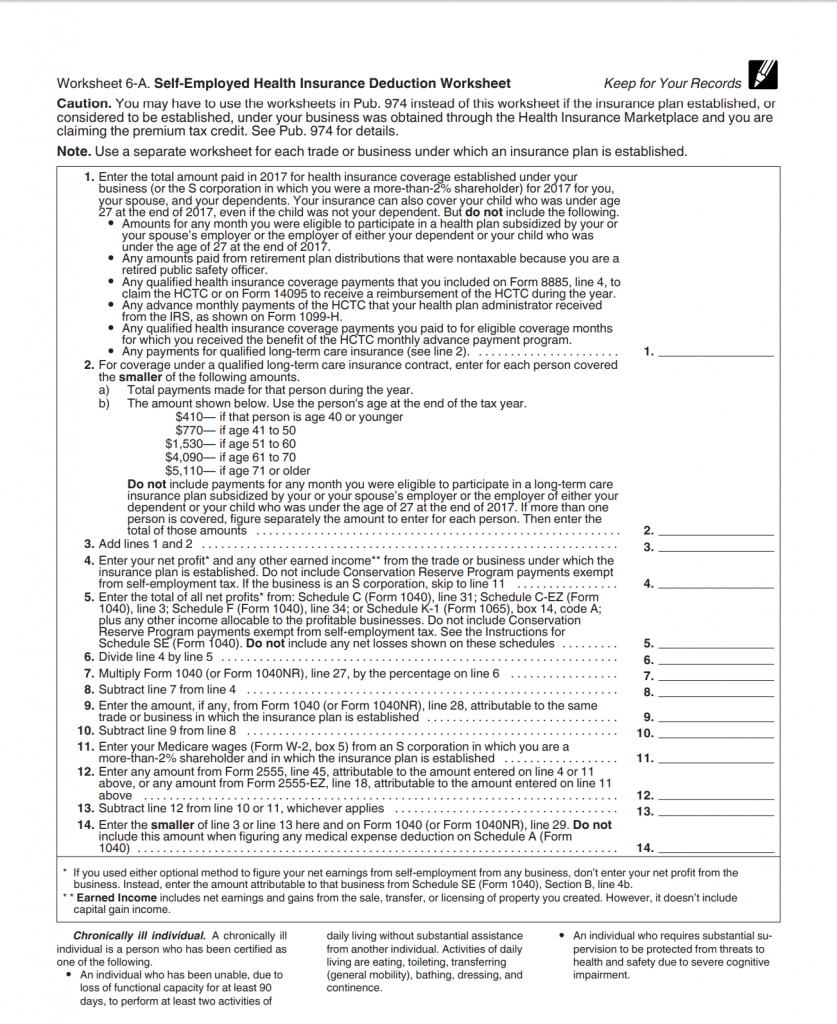

If you are self employed you can also deduct the business part of interest on your car loan state and local personal property tax on the car parking fees and tolls whether or not you claim the standard mileage rate. The self employed health insurance deduction depends on what happens on your tax return. 2017 self employed health insurance deduction worksheet.

And that will help to keep you healthyand happyin 2019 and beyond. Self employed health insurance deduction. The insurance also can cover your child who was under age 27 at the end of 2018 even if the child wasnt your dependent.

You could still claim your health insurance expenses as a medical deduction on schedule a if you itemize but the above the line adjustment to income for self employed people is usually more advantageous. If you purchase your health insurance plan in the name of one of your businesses that business will be the sponsor. For more information on car expenses and the rules for using the standard mileage rate see pub.

A 2 percent shareholder employee is eligible for an above the line deduction in arriving at adjusted gross income agi for amounts paid during the year for medical care premiums if the medical care coverage was established by the s corporation and the shareholder met the other self employed medical insurance deduction requirements. With the rising cost of health insurance a tax deduction can help you pay at least a portion of the premium cost. Congress implemented a 25 percent deduction for self employed health insurance premiums in 1987 and made it permanent.

Deduction for self employed isnt new. Self employed health insurance deduction worksheet form 1040 instructions page 33. If you qualify the deduction for self employed health insurance premiums is a valuable tax break.

Some self employed health care costs are deductible and some are not. Self employed health insurance deduction worksheet form 1040 instructions html.

Get The Facts About The Self Employed Health Insurance

Get The Facts About The Self Employed Health Insurance

How To Deduct Health Insurance Costs If Self Employed

How To Deduct Health Insurance Costs If Self Employed

Self Employed Health Insurance Deduction Healthinsurance Org

Self Employed Health Insurance Deduction Healthinsurance Org

What Is The Self Employed Health Insurance Deduction Ask

What Is The Self Employed Health Insurance Deduction Ask

How To Deduct Health Insurance Costs If Self Employed

How To Deduct Health Insurance Costs If Self Employed

Understanding The Self Employed Health Insurance Deduction

Understanding The Self Employed Health Insurance Deduction

Can I Deduct Health Insurance Premiums If I M Self Employed

Can I Deduct Health Insurance Premiums If I M Self Employed

Self Employed Health Insurance Adjustment For Adjusted Gross Income Agi

Self Employed Health Insurance Adjustment For Adjusted Gross Income Agi

Blog The Tunstall Organization Inc The Tunstall

A Post Aca Subsidy That Already Exists Healthinsurance Org

A Post Aca Subsidy That Already Exists Healthinsurance Org

Self Employed Health Insurance Everything You Need To Know

Self Employed Health Insurance Everything You Need To Know